Why Crypto Market Is Down Today? Expert Insights on Market Volatility

The crypto market experienced heightened volatility in the past 24 hours, triggering significant liquidations. The total crypto market cap slipped 2% to hover about $2.68 trillion on Thursday, April 3, during the mid-Eastern financial market trading session.

As a result, more than $490 million was rekt in the past 24 hours from over 160k traders, mostly involving long traders. The largest liquidation order in the past 24 hours happened on the Binance exchange involving ETH/USDT valued at around $12 million.

Major Forces Behind Today’s Crypto Market Drop

Trade Tensions from U.S. Tariffs and Inflation Fears

On Wednesday, U.S. President Donald Trump concluded the Make America Wealthy Again event with an average 10 percent increase in reciprocal tariffs. Among the most hit by the new reciprocal tariffs are European countries and nations associated with the BRICS movement, led by China, and South Africa.

Although the Trump administration will side at least $600 billion per year from the new tariffs, experts project an increase in inflation to around 5 percent.

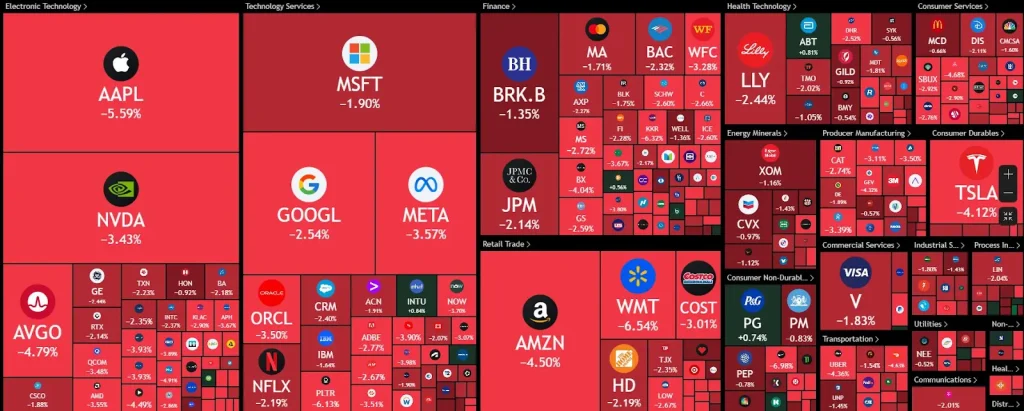

Heavy Selloff in the Stock Market

The mainstream adoption of crypto assets by institutional investors and retail traders has significantly increased the correlation of digital assets with the stock market. In the past 24 hours, following the announcement of the reciprocal tariffs by the United States, the S&P 500 futures erased around $2 trillion of market cap in 15 minutes.

As a result, the crypto market was prone to taking a bearish hit amid heightened levels of further selloff.

Technical Fears

In the past few days, Bitcoin (BTC) price led the wider altcoin market in forming a rising wedge pattern, in the four-hour time frame. With Bitcoin price having been rejected above $87k in the past few days, a crypto correction was imminent, led by Ethereum (ETH).