Crypto Expert Reveals Why Now Is the Best Time to Buy XRP – March Outlook 2025

XRP has been making waves this month, climbing 18.45% since March began. On March 2 alone, its price skyrocketed by 34.08%, turning heads across the crypto market. Over the past week, XRP has gained 13.4%, outpacing giants like Bitcoin, Ethereum, BNB, and Solana.

A well-known crypto analyst, STEPH IS CRYPTO, believes now could be the perfect time to enter the XRP market. His latest analysis points to a major breakout forming on the charts, and if it plays out, XRP could be headed for a significant price surge.

Here’s a closer look at what’s happening and why XRP might be gearing up for a big move.

XRP’s Bullish Chart Pattern

According to the analyst, XRP has formed a falling wedge pattern, a chart formation that often signals a price breakout.

A falling wedge happens when the price moves between two downward-sloping trendlines, gradually tightening. This pattern is generally seen as a sign of an upcoming upward move.

The expert advised investors to ignore the fake breakouts, like the one occurred on March 2. He asserted that if the XRP price closes above the $2.5 level, the next target could be as high as $3.38.

Could a Short Squeeze Push XRP Higher?

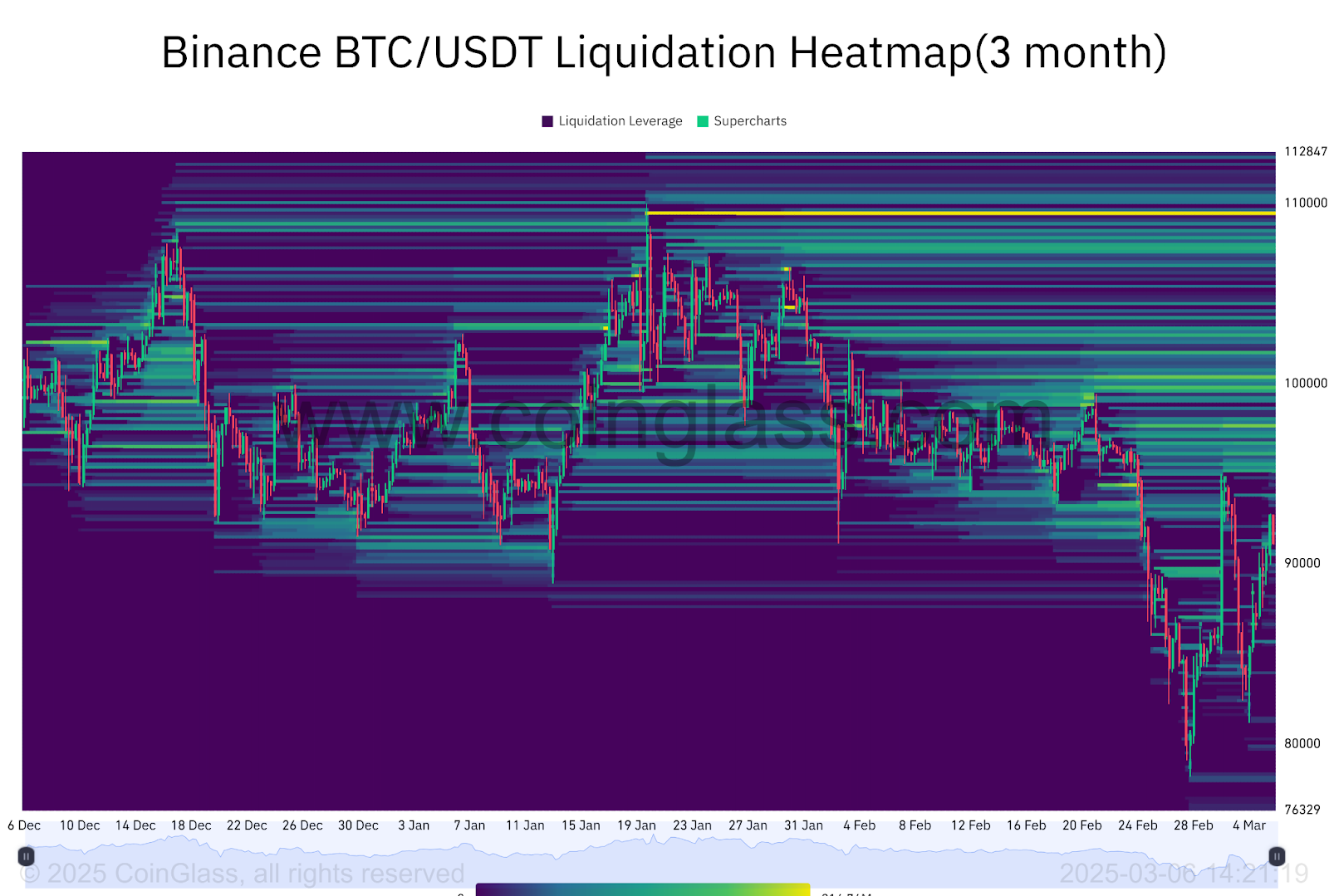

Looking at Binance’s XRP/USDT Liquidation Heatmap, the analyst pointed out that a significant amount of liquidity is concentrated in short positions. This suggests that many traders are betting on XRP’s price to fall.

If market makers take advantage of this situation, it could lead to a short squeeze.

A short squeeze happens when a sudden price jump forces traders with short positions to buy XRP to limit their losses. This rush to cover positions can drive the price even higher.

- Also Read :

- XRP News: Ripple vs SEC Lawsuits To Resolve in March Hint Pro-XRP Lawyer

- ,

Fear is High, But That Might Be a Good Sign

The Crypto Fear and Greed Index currently stands at 25, indicating that fear dominates the market. Yesterday, the index was at 20, and last week it was as low as 10, showing extreme fear among traders.

The analyst pointed out that in the past, extreme fear has often been followed by price recoveries.

With the charts aligning and market conditions shifting, all eyes are on what happens next.