Chainlink Price Drops 7.77% Amid Oracle Glitch, Will LINK Price Go Back Up?

Chainlink, often regarded as a pioneer in the oracle sector, is in the spotlight for the wrong reasons. A recent issue with a Chainlink oracle update led to over $532,000 in user fund losses in mere 180 seconds. The incident has ignited criticism and questions around Chainlink price in the short term. From a price standpoint, LINK price has shedded 7.79% in a day to $14.54. In response, investors are eyeing on-chain data and Chainlink price analysis to determine where LINK might be headed next amid this turbulence.

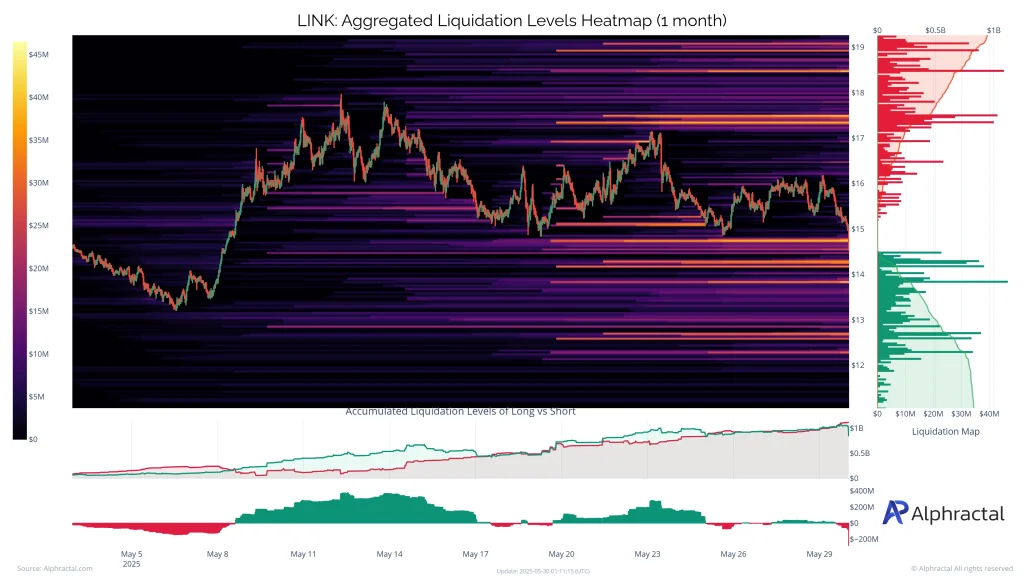

What Does the Liquidation Heatmap Say?

Recent liquidation heatmap from Alphractal paints a turbulent picture for LINK. The map shows a sharp spike in long liquidations over the last week. This is often associated with capitulation phases, where excessive leverage on the long side gets wiped out. Interestingly, as of today, that is May 30th, the liquidation concentration has shifted, the bulk of the remaining potential liquidations are now in short positions.

Successively, when short liquidations become predominant, they can act as a catalyst for a price surge. Historically, large-scale long liquidations often mark local bottoms, leading to price rebounds. Therefore, if LINK can hold its ground near current levels, a short squeeze scenario could push the LINK token upward quickly.

Also read our Chainlink (LINK) Price Prediction 2025, 2026-2030!

LINK Price Analysis:

Chainlink’s trading price is currently around $14.54, with an intraday decline of 7.77%. The token’s market cap now hovers around $9.56 billion, accompanied by a 24-hour trading volume of $598.92 million. LINK’s trading range for the past day shows a low of $14.46 and a high of $15.91.

Technically, the breakdown below the current level could trigger a drop to the next crucial support zone at $13.86. Conversely, if bulls manage to reclaim the $16 level, a test of $17.4 could be in the cards. This zone acted as strong resistance earlier, and breaking it could renew medium-term bullish momentum. Above that, $19.8 stands as a more distant, yet critical, resistance.